colorado estate tax form

Application forms are available from the Colorado Department of Military and Veterans Affairs Division of Veterans Affairs 7465 E. State Capitol Suite 141.

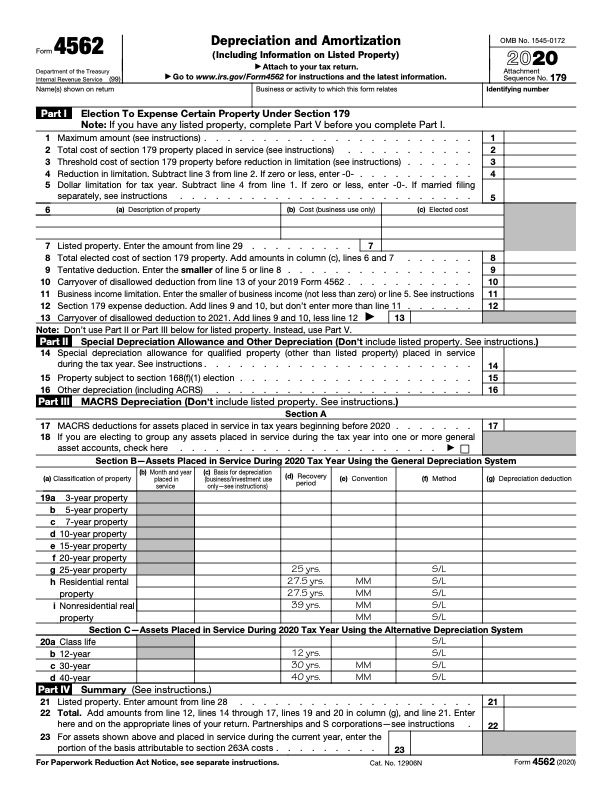

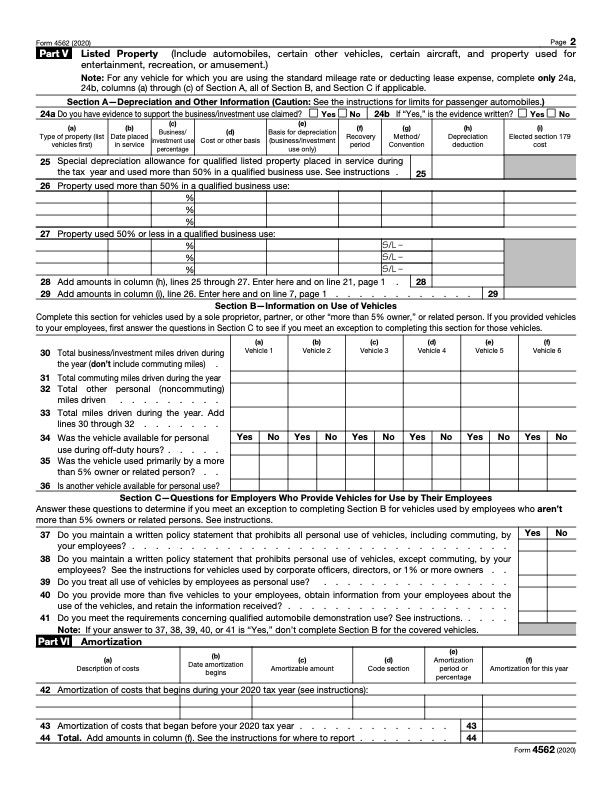

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

DR 0105 Book - Colorado Fiduciary Income Tax Filing Booklet.

. Application for an Affidavit Emissions Extension. DR 0158-I - Extension of Time for Filing Colorado Individual Income Tax. All forms must be completed in English pursuant to Colorado law see 13-1-120 CRS.

DR 1830 - Material Advisor Disclosure Statement for Colorado Listed Transaction. There are also in fact three cities in Colorado that assess a local income tax so make sure you check on your specific city. Instructions for Closing an Estate Formally Download PDF Revised 0919 JDF 958 - Instructions for Closing a Small.

Study of the state property tax deferral program on behalf of the Office of the Governor. Residential Properties Specific Forms For Charitable-Residential Properties. There is no estate tax in Colorado.

DR 0104EP - Individual Estimated Income Tax Payment Form. Property Taxation - Declaration Schedules. Every nonresident estate or trust with Colorado-source income must file a Colorado Fiduciary Income Tax Return if it is required to file a federal income tax return or if a resident estate or trust has a Colorado tax liability.

Please submit completed declaration schedules to the Colorado county assessors office in which the property is located as. DR 0104PN - Part-Year ResidentNonresident Tax Calculation Schedule. Affidavit of Non-residence and Military Exemption from Specific Ownership Tax.

Ad The Leading Online Publisher of Colorado-specific Legal Documents. The Property TaxRentHeat Rebate program. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone.

In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed. The state income tax rate is.

Annual Statement of Property Forms. Great Colorado Payback - Colorados Unclaimed Property Program. Colorado Estate Tax.

May increase with cost of living adjustments. Estate Tax Return Tax Return. DR 1778 - E-Filer Attachment Form.

Closing Agreement - Estates Trusts. DR 1210 - Colorado Estate Tax Return. By filing the Property TaxRentHeat Rebate Application Form 104PTC.

State residents who. DR 1083 - Information with Respect to a Conveyance of a Colorado Real Property Interest. DR 0104US - Consumer Use Tax Reporting Schedule.

DR 5714 - Request for Copy of Tax Returns. DR 0104TN - Colorado Earned Income Tax Credit for ITIN Filers. JDF 205 - Motion to File Without Payment of Filing Fee or Waive Other Costs Owed to the State and Supporting Financial Affidavit Download PDF Download Word Document Revised 0521 JDF 206 - Finding and Order Concerning Payment of Filing Fees Download PDF Download Word Document Revised 0521 JDF 711 SC - Notice of Hearing.

1313 Sherman STG 419 Denver CO 80203. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is based on this credit. DR 0104X - Amended Individual Income Tax Return.

Get Access to the Largest Online Library of Legal Forms for Any State. Or 500000 if filing jointly -- will be available in an amount equal to the property tax credit they qualified. They will average around half of 1 of assessed value.

The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio. The estate tax is levied on an estate after a person has died but before the money is passed on to their heirs. 200 East Colfax Avenue.

It is sometimes referred to as the death tax The estate tax is different from the inheritance tax. What Is the Estate Tax. This is administered through the Colorado Department of Revenue State Income Tax system and is based on your income.

For more information follow this link to the. Form DR 1210 is a Colorado Estate Tax form. DR 0253 - Income Tax Closing Agreement.

Their telephone number is 303 343-1268. Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein. Application for Change of Vehicle Information IRP DR 2413.

Estate Trust Estimated Tax Voucher Extension. DR 0900F - Fiduciary Income Payment Form. The following are the federal estate tax exemptions for 2022.

Denver CO 80203. DR 0104EP- Individual Estimated Income Tax Payment Form. Property taxes in Colorado are definitely on the low end.

DR 0104EE - Colorado Easy Enrollment Information Form. DR 0105 - Colorado Fiduciary Income Tax Return form only DR 0158-F - EstateTrust Extension of Time for Filing. Application for Low-Power Scooter Registration.

DR 0104TN - Colorado Earned Income Tax Credit for ITIN Filers. 39-3-201 et seq Colorado Revised Statutes. Forms can also be obtained from their web site at wwwdmvastatecousviewpagephpUGFnZUIEPTU.

Pursuant to 39-3-1195 the personal property minimum filing exemption threshold exemption amount for tax years 2021 and 2022 is 50000 or less in total actual value. DR 0104PN - Part-YearNonresident Computation Form. DR 0104CR - Individual Income Tax Credit Schedule.

Affidavit of Non-Commercial Vehicle. Payment for Automatic Colorado Extension for Estates or Trusts Extension. It is one of 38 states with no estate tax.

1st Avenue Suite C Denver CO 80230. Application for Property Tax Exemption. State wide sales tax in.

Colorado has no estate tax for decedents whose date of death is on or after January 1 2005. DR 5782 - Electronic Funds Transfer EFT Program Information. The Office of the Governor consulted with the State Treasurer in commissioning the study as required by the SB21-293.

DR 0104US - Consumer Use Tax Reporting Schedule. DR 1102 - Address or Name Change Form. Open an Estate Forms.

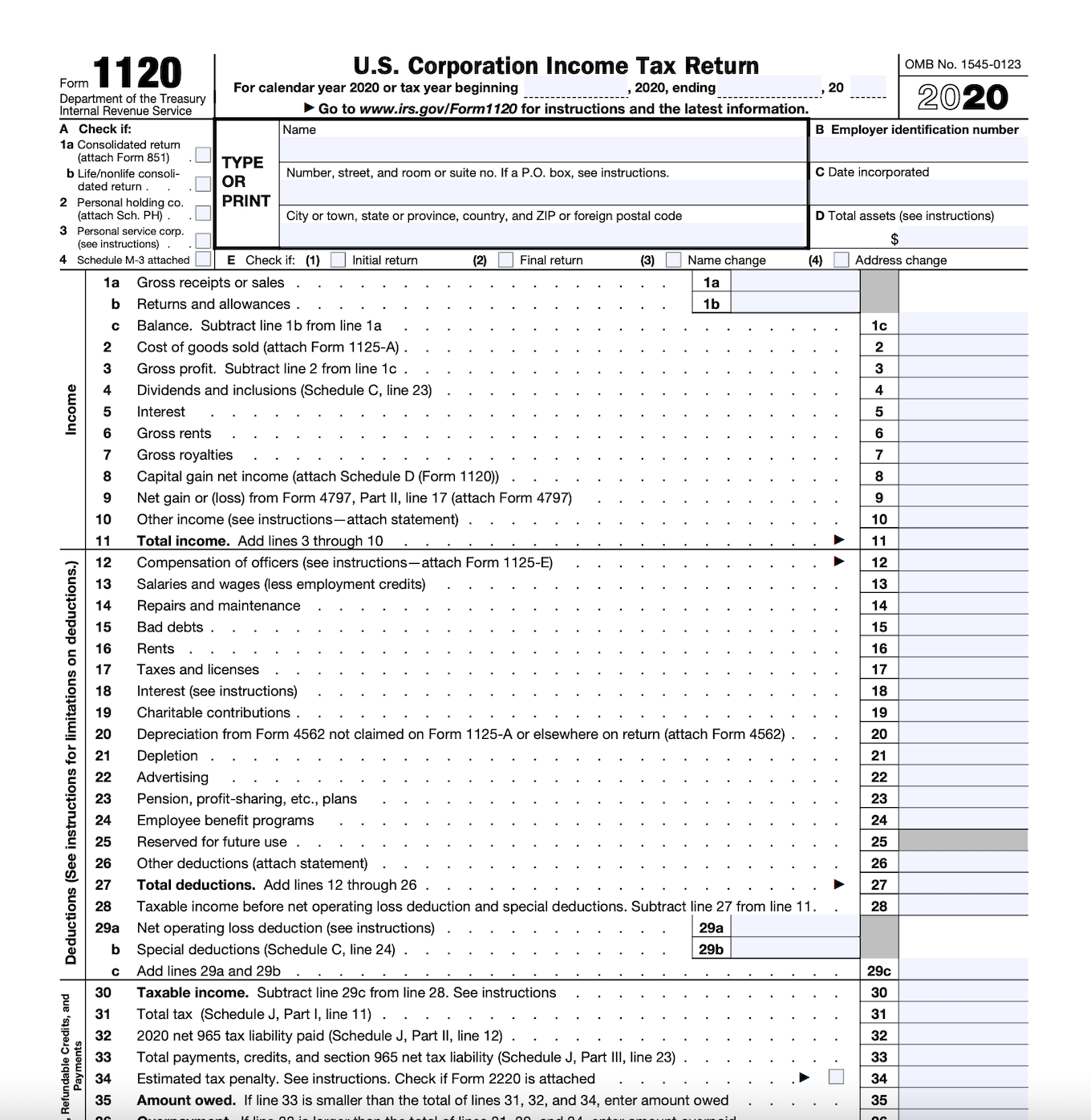

Form 1120 How To File The Forms Square

Real Estate Exam Cheat Sheet Real Estate Exam Real Estate Business Plan Real Estate Forms

Contract Summary Timeline Is A Lifesaver At Closing Real Estate Marketing Plan Real Estate Checklist Real Estate Contract

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Understanding The 1065 Form Scalefactor

What Is Schedule C Tax Form Form 1040

How Do I Find Last Year S Agi Income Tax Return Turbotax Adjusted Gross Income

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

1977 Quebec Tax Form Partial Tax Forms Tax Partial

:max_bytes(150000):strip_icc()/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Nationwide Tax Consultation Preparation Tax Accountant Tax Tax Services

/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Tax Form Templates 5 Free Examples Fill Customize Download

How To File Taxes For Free In 2022 Money

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

What Is Schedule C Tax Form Form 1040

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition